LIFE & CULTURE

XpatAthens

How To Obtain A Greek Tax ID (AFM) As An Expat Or Non-Resident In Greece

This nine-digit number, pronounced "AFIMI" in Greek, is something you’ll use regularly for tasks such as:

- Getting a Greek phone number in your name.

- Leasing a home or property.

- Logging into TAXISnet to interact with government systems.

- Filing taxes and generating tax certificates.

- Purchasing property or a car.

- Completing many other daily tasks.

- A copy of your passport.

- First and last names of your parents.

- Your home address (outside Greece) and temporary address in Greece (if applicable).

- Your foreign tax number.

- Your mobile phone number.

- An authorization form if you are appointing a tax representative to apply on your behalf.

- Liaising with the tax office and government departments, especially for those on spouse visas, Digital Nomad Visas, and Golden Visas.

- Receiving notifications from the tax office and keeping you updated.

- Opening a TAXISnet account for you.

- Assisting with property or car purchases, leasing, and other related tasks.

This content has been created in collaboration with our trusted partner Tsaks Consulting.

How To Start A Private Limited Company (IKE) In Greece: A Step-By-Step Guide

- Separate Legal Entity:

An IKE company is a completely separate legal entity, distinct from its owners. This separation is critical from a legal and liability perspective, as it allows the company to incur debts and conduct business in its own name, offering significant protection to its members. - Scope of Members:

An IKE company can have one or more members. A single-member IKE company is known as an SMPC (Single-Member Private Company). - Company Duration:

The default duration of an IKE company is 12 years. However, this can be modified through amendments to the company’s articles. Members can also vote to extend the duration beyond 12 years. - Capital Requirements:

Only 1 euro is required to establish an IKE company, making it accessible. Contributions can be made in various forms, including non-cash assets. - Limited Liability:

Members have no financial risk beyond their contribution, except in very limited cases where administrators may be personally liable for tax or social security debts.

This content has been created in collaboration with our trusted partner Tsaks Consulting.

Understanding Greek Rental Laws & Property Ownership

Renting In Greece: Your Rights & Responsibilities

Renting a property as an expat in Greece comes with specific rights and duties that protect both tenants and landlords. Here’s what you need to know:

Key Rental Laws in Greece

- Lease Agreements Are Binding:

- Greek rental agreements typically last three years unless otherwise stated.

- Verbal agreements are valid but always insist on a written contract for clarity and legal backing.

- Security Deposits:

- Landlords can request up to two months’ rent as a security deposit.

- This deposit is returned at the end of the lease, provided there’s no damage or unpaid rent.

- Eviction Rules:

- Tenants cannot be evicted arbitrarily.

- Greek law mandates a legal process for evictions, safeguarding tenant rights.

Tenant Responsibilities

- Rent Payments: Always pay your rent on time to avoid disputes.

- Property Care: Tenants are expected to maintain the property and report major repairs to the landlord.

Pro Tip: When negotiating a lease, double-check who’s responsible for utilities and maintenance fees—it’s not always clear in contracts.

Owning Property In Greece: What Expats Need To Know

Dreaming of taking the next step owning a slice of Greek history? Buying property in Greece involves some unique legal requirements for foreigners. Here’s a quick rundown:

Foreigners Can Own Property—With Conditions

- Expats from EU countries face no restrictions when buying property.

- Non-EU citizens may need special permission to purchase properties in border regions (e.g., islands near Turkey).

The Purchasing Process

- Hire a Lawyer: A Greek Lawyer can help you verify the property’s legal status and ensure there are no outstanding debts, burdening the property.

- Obtain a Greek Tax Number (AFM): This number is required for any property transaction.

- Notary Involvement: All property sales must be finalized through a notary, ensuring a legal and transparent transfer.

Taxes and Fees

- Expect to pay around 8-10% of the property’s value in taxes and fees, including transfer tax, legal fees, and notary costs.

- Property owners are also subject to annual ENFIA (property tax).

Navigating Legal Challenges As An Expat

Despite Greece’s welcoming charm, expatriates can face occasional legal hiccups. Here’s how to stay ahead of potential pitfalls:

- Understand Your Lease: Don’t sign anything you don’t fully understand—have a bilingual lawyer or translator review the terms.

- Verify Property Ownership: Before purchasing, confirm the seller has clear ownership rights and that the property is free from legal disputes.

- Keep Track of Deadlines: Rental agreements, taxes, and permits often come with strict timelines. Missing a deadline can lead to hefty fines.

Helpful Resources for Expats

- Greek Ombudsman Office: Handles disputes between landlords and tenants.

- Local Real Estate Agents: Familiar with expat-friendly properties and their legal nuances.

Why Understanding Greek Property Laws Matters

Whether you’re renting or buying, knowing your rights and responsibilities ensures a smooth experience in Greece’s real estate market. Understanding tenancy laws protects you from unfair practices, while navigating ownership regulations lets you invest with confidence.

Relocating to Greece is a dream for many, but it pays to do your homework. With the right legal guidance, you’ll enjoy the sun, sea, and history without a hitch.

FAQs

1. Can expats negotiate rental agreements in Greece?

Yes! Lease terms can often be negotiated, but always get the agreement in writing to avoid misunderstandings.

2. Are Greek property taxes high?

Not particularly, but property owners must budget for annual ENFIA taxes and one-time transfer fees during the purchase process.

You can take legal action, as Greek law requires landlords to return deposits unless there’s documented damage or unpaid rent.

For more in-depth information on expat legal matters in Greece, check out Expat Law’s Guide on Greek Rentals.

The Athens Singers

An Acropolis Museum Christmas

- When: Weekly tours (check availability)

- Where: Periodical Exhibitions Hall

- Admission: Free entry (reservations required via events.theacropolismuseum.gr)

- Extras: Audio-guided tours via QR code for an independent visit

- When: Friday, December 27, and Monday, December 30

- Time: 10:30 AM & 12:30 PM

- Ages: 6–12 years

- Cost: Free for children (with adult day admission)

- Reservations: Open December 17 via events.theacropolismuseum.gr

- When: Saturday, December 28, and Sunday, December 29

- Time: 10:30 AM & 12:30 PM

- Ages: 3–5 years

- Cost: Free for children (with adult day admission)

- Reservations: Open December 17 via events.theacropolismuseum.gr

Enjoy musical performances that bring the holiday spirit to life:

- Sunday, December 22: Students from the Pallini Experimental Music School Choir and Orchestra perform Christmas classics at 12:00 PM.

- Monday, December 23: The Cretan Dance Group performs traditional dances and carols at 12:30 PM.

- Saturday, December 28: The Air Force Band plays timeless Christmas melodies at 12:00 PM.

- Monday, December 30: Students from the Athens Music School Jazz Ensemble perform festive jazz hits at 12:00 PM.

- Reservations: Call 210 9000915

Christmas At The Maria Callas Museum

Sunday, December 15th

- Date: Sunday, December 15th

- Time: 11:30 AM - 1:30 PM

Hot Chocolate Jazz Session

Sunday, December 15th

- Niki Kokkoli (Saxophone)

- Theodoros Ziarkas (Double Bass)

- Phoebe Pechlivanidi (Piano)

- Date: Sunday, December 15th

- Time: 5:00 PM - 7:00 PM

- Admission: Free (Limited seating; priority will be given on a first-come, first-served basis)

Saturday, December 28th

- Date: Saturday, December 28th

- Tour Times: 11:00 AM & 12:00 PM (Limited seating; priority will be given on a first-come, first-served basis), Piano Performance: 11:00 AM - 2:30 PM

Thursdays, December 12th & 19th

- Dates: December 5th, 12th & 19th

- Time: 12:00 PM (December 5th & 12th), 12:30 PM (December 19th)

- Tour Duration: 50 minutes

- Admission Fee: €7 (for visitors aged 65+), guided tour included

- Reservations: Call 210 44 04 204

Sunday, December 27th

- Date: Sunday, December 27th

- Time: 5:00 PM - 6:15 PM

- Ages: 4-8 years

- Cost: Free

- Reservations: Call 210 44 04 204 (Tuesday - Saturday: 10:00-18:00)

Sunday, December 15th

- Date: Sunday, December 15th

- Time: 9:30 AM - 10:20 AM

- Ages: 8 months - 2.5 years

- Cost: €10 (for one infant and one guardian)

- Reservations: Call 210 44 04 204 (Tuesday - Friday: 10:00-18:00)

Sunday, December 22nd

-

Date: Sunday, December 22nd

-

Time: 10:00 AM - 11:00 AM

-

Ages: 1-3 years

-

Cost: Free

-

Reservations: Call 210 44 04 204 (Tuesday - Saturday: 10:00-18:00)

Greek Property Laws & Compliance

It’s no secret that buying and selling property in Greece comes with a lot of red tape! Thankfully in recent years there have been significant efforts made to organize and simplify property related processes, not to mention a massive leap in digitization.

To help you along in the process, we recommend that you have the below checklist of Greek property portfolio documents in order. Of course, every case is unique and the below may not cover your specific property needs.

Feel free to reach out to us with your questions and we’ll connect you with a trusted professional.

* Building Permit and revisions if any

* Authorized Drawings attached to the building permit

* Declaration/Drawings of Law No. 3843/10 if submitted

* Declaration/Drawings of Law No. 4495/17 (or Law No. 4178/13, 4014/11)

* As Built Drawings/Floor Plans

* Title Deeds

* Energy Performance Certificate

* Structural Report or Structural Stability Report if required

* Certification of Construction Inspection if issued

Here is a more detailed look at some of these requirements:

Declaration of Property in Greece - Law No. 4495/17

The first step in verifying the legal status of your property in Greece is to conduct an on-site inspection after gathering authorized building plans and licenses.

If illegalities have been determined, we can begin the initial phase of declaring the property. Through the electronic system of the Technical Chamber of Greece, the owner will be given a unique application code of the declaration and the invoice of the initial lump-sum payment necessary to validate the process.

Fines are determined depending on property size, the type of use of the structure, the frame time it was built, as well as the area’s set tax value. The fees required for each declaration and completion of final documentation/property portfolio differ depending on the nature, size and complicity of the structure.

Electronic Building ID Code & Certificate

The Electronic Building ID Code is a key tool that provides detailed information for all registered properties in Greece. Property transactions and title searches are now simpler, faster and most importantly, more transparent. This code, which can also be described as the “as-built status” of a property, is representative of what has been built on-site in terms of dimensions, area surface and use of buildings.

All property transactions cannot be complete without the Electronic Building ID Code Certificate which is issued for all buildings and parcels without structures and valid for 2 months. If there are any layout, facade and property-use changes, the Building UD Code must be updated to ensure the legal status of the property.

All information collected from building permits and drawings, the Greek Tax Authorities, Hellenic Cadastre details, Declarations of Legality and Energy Performance Certificates are all recorded on an electronic database. These details are then all electronically linked to Greek authorities and public entities related to property ownership to secure access to the exact same property information.

Energy Performance Certificates & Inspections

According to Greek Law, all deeds of conveyance and rental agreements for existing buildings are complete and valid only after an Energy Performance Certificate is issued and submitted to the Greek tax office or notary public. Energy Performance Certificates (or EPC’s) are unique documents issued through an electronic system of the Greek Ministry of the Environment only by Certified Energy Inspectors; they state the level of efficiency in terms of energy consumption after concluding an inspection of the building in question.

In order to collect the data needed for certification, we will visit your property and its surroundings to conduct a thorough inspection. During this process we will access each room for a general overview of insulation/exterior shading, note the size and type of glazing structures, inspect the heating, hot water, cooling and lighting system (in cases of commercial property). If floor plans are not provided, the property will be measured on-site. Following the inspection process, a certificate will be issued and valid for 10 years regardless of rental and ownership title changes.

If you're looking for the right professional to handle things efficiently and stress-free - we can help! Contact us whenever you’re ready and we’ll connect you with tried and trusted partners.

This content has been created in collaboration with our partner K Sirouni Architects.

A Short Guide On How To Become A Greek Tax Resident

The method and implications of becoming a tax resident of Greece is one of the first things you will need to understand if you are considering moving to Greece. It will have implications in your daily life, and before you know it, after living in Greece for a week or two, you will be asking yourself “how do I become a tax resident of Greece?” This short guide will take you through the steps of becoming a tax resident in Greece.

Why do I need to become a tax resident in Greece?

If you stay over 183 days in Greece you are considered a tax resident. It’s a good idea to register as a tax resident so you don’t have any issues with the Greek authorities down the line including potential penalties. In addition, if you are living in Greece, it’s a lot easier to have your tax residency completed for ever day tasks such as medical, buying and selling cars and accessing government services.

What does it mean to be a tax resident in Greece?

If you become a tax resident of Greece than you will be required to pay tax on your worldwide income. You need to plan accordingly for this, especially if you have properties or other income overseas as this will need to be taxed.

There are some tax regimes in Greece which are particularly attractive for foreign residents who move their tax incentives to Greece. These have been designed to make it attractive for foreigners to move their tax residency to Greece and to move to Greece.

These include the 50% tax discounts (Non-Dom Tax Regime) which entitles people to a 50% tax break if they move their business or employment to Greece, as well as the special tax regime for foreign pensioners which offers a flat tax rate of 7%. Our tax team can help you understand if you are eligible for either of these incentives and guide you through the process of making an application.

Should I use a tax representative to assist me in Greece?

If you stay in Greece over the 183 day period (there are a number of more specific requirements and definitions which our tax team can assist you with), you may prefer to appoint a tax representative. This is helpful if you don’t speak the language or if you don’t understand the tax system. Your tax representative can be an accountant, lawyer or financial advisor and you can use them to manage your communication, work through the process, submit paper work and generally authorize them to act on your behalf for your dealings with the tax office in Greece. They can update your residency status in Greece and also make the appropriate declarations to the Greek tax authorities and ensure that you comply with all the laws and regulations.

If you plan to stay in Greece for longer than 183 days, you should definitely consult a tax professional and declare your income as required. We're here to help - feel free to reach out to us with your questions.

This content has been created in collaboration with our trusted partner Tsaks Consulting.

Start A Business In Greece | Types Of Companies

Starting a company in Greece is a straight forward process. Before getting started, it is important to decide on the most appropriate company structure for your business and proposed operations. This article is a short guide to the various business entity options.

Feel free to ask us your questions and our team of experts will be happy help you. Also take a look at our business services as they might just be the peace of mind you’re looking for!

Sole Proprietorship (Atomiki Epihirisi)

This is a very simple business entity where there is no separation between the owner and the business. It is easy and quick to establish and there is no liability protection. Sole decision making is one feature and the owner has control over business decisions as there is no separate legal entity.

Private Limited Liability Company (IKE – Etaireia Periorismenis Efthinis)

Many investors and business people chose to establish a private company (IKE) as it is a simple and flexible company structure. An IKE is established by one or more persons who owns shares. Liability is limited. The minimum capital requirement is €1 and there is an administrator (no board of directors). There are statutory audit requirements which are undertaken in line with EU directives. The legal representatives have liability and the time required for incorporation is approximately five days. This company structure is suited for small and middle sized companies who require flexibility to operate.

General Partnership (OE – Omorrythmi Etaireia)

This is a business structure where two or more people are jointly liable for losses, management responsibilities and of course profits. Each partner is personally liable for the debts and financial obligations of the business. Any creditors are able to go after the partners in their personal capacity. There is generally a written partnership agreement which dictates profit sharing, management responsibilities and other issues. Generally speaking, all of the profits (and losses) are shared equally, unless something different is specified in the agreement. There is pass-through taxation, meaning that the profits pass through to the partners personal income tax returns and aren’t allocated to the company. There are risks of personal liability for general partnerships which need to be considered.

Limited Partnership (EE – Eterorythmi Etaireia)

The Limited Partnership (EE) company is a very popular option because there is only unlimited liability for one partner. The other partners have their liability limited to their individual contributions. It provides a combination of both a partnership and corporation in terms of characteristics. The benefit from a liability perspective is that the limited partners have their liability limited. This is similar to a corporation and protects the personal assets of the limited liability partners. Most of the time, the general partners are highly active in the day to day activities and management of the company. In addition, there are same tax incentives since there is pass through taxation and the flat rate is generally chargeable for each partner. This is a useful structure for the ‘silent partner’ structure which popular in many western countries. There is no minimum capital share requirement for this entity and EEs are governed by the Greek Civil Code.

Public Limited Liability Company (AE – Anonymi Etairia)

This company type is generally suitable for larger businesses or enterprises who are looking to raise capital from the public. There is a minimum share capital amount of 24,000 euros. Given the public nature of these companies, the regulations, reporting requirements and oversight of the companies is much more extensive than for IKE companies. In addition, the shares issued in AE companies can be traded on the stock exchange. This helps enable quick access to large amounts of capital as well as increase in liquidity.

If you're thinking about starting a business in Greece, we can help! Get in touch with us and our team of experts will be happy to answer your questions.

This content has been created in collaboration with our trusted partner Tsaks Consulting.

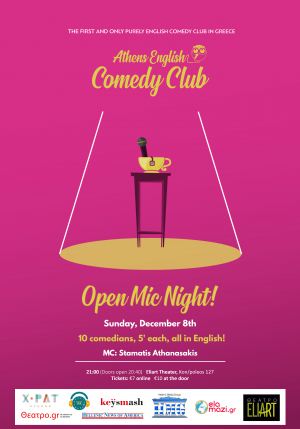

Athens English Comedy Club OPEN MIC NIGHT!

Deadline: Midnight, Tuesday December 3rd

(Spots not guaranteed, we will contact you on Wednesday December 4th to confirm if you are in the lineup).

Time: 21:00 (Doors open 20:40)

Tickets: €7 online / €10 at the door

Duration: 1h30 + interval

Recommended for ages 16+

Address: ELIART Theater - Konstantinoupoleos 127 (closest to Kerameikos and Metaxourgeio metro stations).

The theatre is wheelchair accessible.