XpatAthens

2nd Full-Day Conference Of The Child & Adolescent Mental Health Initiative

Things You Didn’t Know About Greek Mythology

Here are some surprising things you might not know about Greek mythology!

1. Zeus Wasn’t Always the Supreme God

-

Elysium – A paradise for heroes and the virtuous.

-

Asphodel Meadows – A place for ordinary souls who weren’t exceptionally good or bad.

-

Tartarus – A deep abyss where the wicked were punished, including the Titans. This complex afterlife system showcased how Greek mythology viewed justice beyond the mortal world.

Gilad Atzmon's Bass Less Quartet Live At Theatre Of The No

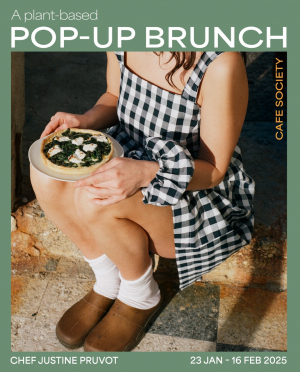

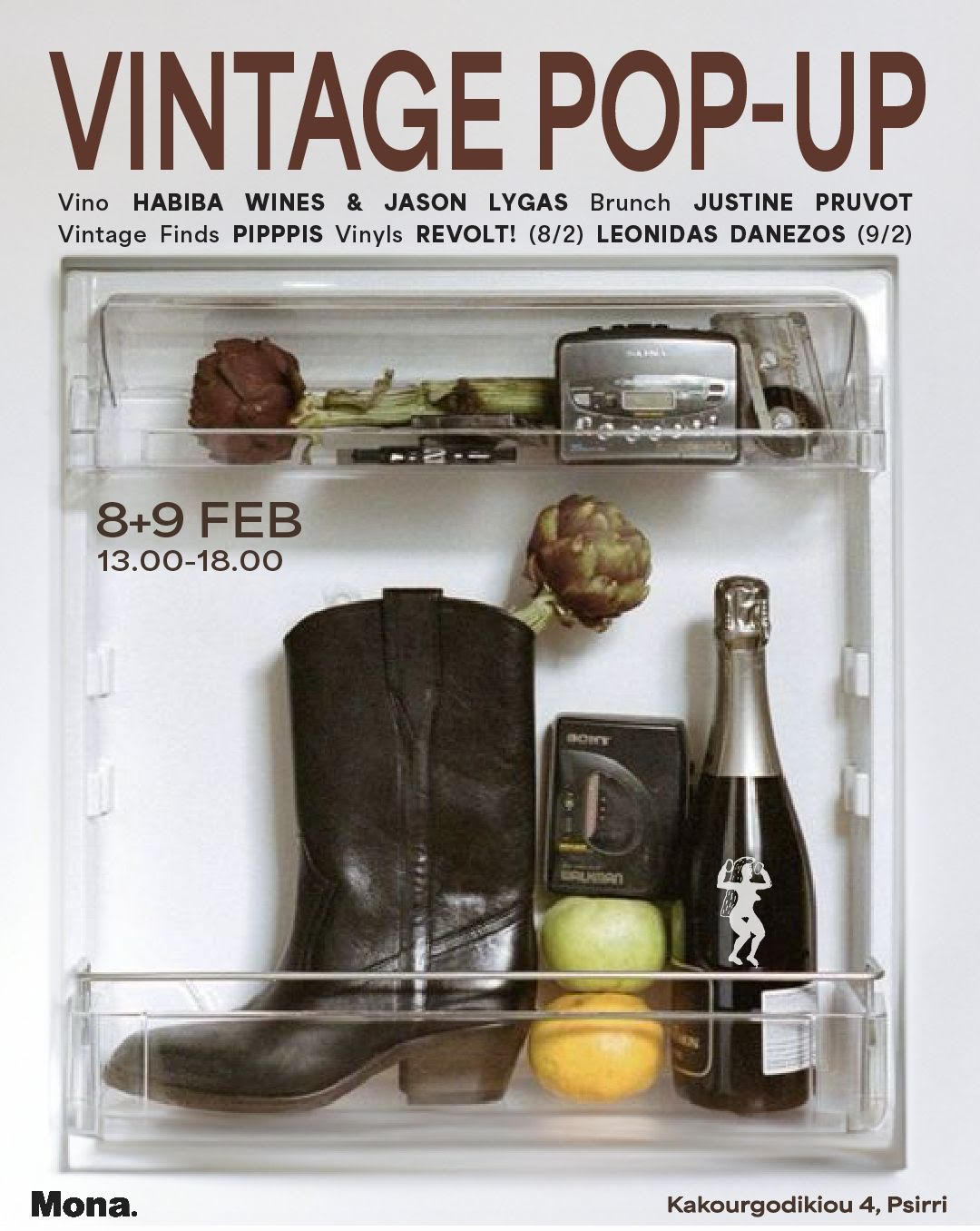

A Plant-Based Pop-Up Brunch At Mona Athens

📅 Now until February 16

🕐 13:00 – 18:00 Brunch

📍 Mona’s Living Room

February At The Maria Callas Museum

Wednesday, February 12th

- Date: Wednesday, February 12th

- Showtimes: 19:30 & 21:00

- Duration: 45 minutes

- Price: €25 (includes Museum entry before the show, optional)

- Required reservation via more.com. Book your tickets HERE!

- Note: Part of the performance will be standing.

Sunday, February 16th

- Date: Sunday, February 16th

- Time: 12:00

- Duration: 65 minutes

- Ages: 4-12 years

- Price: €10 per child & €10 for a companion

- Required reservation via more.com. Reserve your spot HERE!

Saturday, February 22nd

- Date: Saturday, February 22nd

- Time: 12:30

- Duration: 50 minutes

- Price: €14 (Discounts available)

- Required reservation via more.com. Book your spot HERE!

Every Thursday in February

- Dates: Thursdays (6, 13, 20, 27 February)

- Time: 12:30

- Duration: 50 minutes

- Price: €7 for 65+ (Tour is free)

- Call to reserve: 210 44 04 204

Sunday, February 9th

- Date: Sunday, February 9th

- Time: 11:30-12:30 & 13:15-14:15

- Ages: 4-8 years

- Price: €13 per child and companion

- Required reservation: 210 44 04 204 (Tuesday-Saturday 10:00-18:00)

Sunday, February 23rd

- Date: Sunday, February 23rd

- Time: 11:30-12:30

- Ages: 4-10 years

- Price: €10 per child and companion

- Required reservation: 210 44 04 204 (Tuesday-Saturday 10:00-18:00)

Sunday, February 23rd

- Date: Sunday, February 23rd

- Time: 9:30 AM

- Ages: 8 months to 2.5 years

- Price: €10 per child and companion

- Required reservation: 210 44 04 204 (Tuesday-Saturday 10:00-18:00)

Stoiximan AegeanBall Festival, A Celebration Of Basketball, Returns This June

Understanding Tax In Greece | Double Taxation

- Income Tax

- Capital Gains Tax

- Value Added Tax (VAT)

- Social Security Tax

- Wealth Tax

- Inheritance Tax

- General Tax Advice and Structure

- Double Taxation Agreements with countries such as the US, UK, Australia, Canada, and Israel

- Establishing Tax Residency

- Tax Compliance for companies and individuals

- Shipping and Vessel Taxation

- Greek Tax Incentives for Foreigners

- Your permanent home is in Greece.

- You have resided in Greece for more than 183 days within a twelve-month fiscal year, even if not consecutively.

- Income Tax: Employers deduct the appropriate tax amounts from salaries each month for employees and businesses.

- Capital Tax: Gains from interest, royalties, lottery winnings, inheritance, or property transfers are taxed at rates ranging from 10% to 20%.

- Value Added Tax (VAT): Standard VAT is set at 24%, with some services qualifying for reduced rates.

- Social Security Tax: Employers contribute 25.06%, while employees contribute 16% of salaries.

This content has been created in collaboration with our partner Tsaks Consulting.

Greece’s 7% Foreign Income Tax Scheme | A Game-Changer For Retirees

-

Tax Residency Requirement: You must not have been a tax resident in Greece for five out of the last six years prior to transferring your tax residency.

-

Country Agreements: Your current country of tax residency must have a tax cooperation agreement with Greece. To check whether your country qualifies, inquire with Tsaks Consulting with your question.

-

0% Capital Gains Tax: Profits from sales, such as stocks or business shares, are not taxed—a significant advantage for investors.

-

Low Dividend Tax Rate: A flat 5% tax on dividends makes it easier to grow your savings through investments.

-

A rich history with countless archaeological sites to explore.

-

A lifestyle that caters to high-end retirees.

-

A lower cost of living compared to much of Europe.

-

Access to a high-quality healthcare system.

-

Excellent global connectivity for travel.

-

Incredible cuisine and the charm of the Mediterranean lifestyle.

-

Vibrant cities to serene islands like Crete and Rhodes that are great all year round.

For EU citizens, the residency process is straightforward. You’ll need to register your residency within the first three months of your arrival and obtain an EU residence card to transfer your tax residency.

Non-EU nationals have several residency options, including:

-

FIP Residency (Financially Independent Person Visa): A renewable visa that allows for a three-year stay in Greece.

-

Golden Visa: A residency-by-investment scheme with specific minimum investment requirements, which our team can guide you through.

-

Tax Benefits: Greece’s 7% foreign tax resident scheme offers significant savings, particularly for those who split their time between Greece and other countries. With agreements in place with many nations worldwide, there’s a strong likelihood your country qualifies. Additionally, the lower cost of living in Greece adds to the financial advantages of retiring here.

-

A Dream Come True: Many simply fall in love with Greece—whether it’s the picturesque islands of Santorini, the cosmopolitan charm of Athens, or the natural beauty of Crete and Rhodes. For these retirees, the tax benefits are a bonus to fulfilling their dream of living in Greece.

This content has been created in collaboration with our trusted partner Tsaks Consulting.

All You Need To Know About ENFIA Property Tax In Greece

The supplementary tax applies to legal entities only and is 5.5% of the property’s value—a significant amount. However, this is reduced to 1% if the property is used for business purposes, such as a warehouse for a plumbing company storing supplies and serving clients.

Once you receive your ENFIA tax bill, you have two options:

- Pay it in full by the end of the month in which you received the tax assessment.

- Pay it in 10 monthly installments.

Follow these steps to receive your ENFIA assessment:

- Own property in Greece: Whether you purchase, inherit, or already own real estate in Greece, you must file the necessary paperwork.

- Submit your E9 form: This form is submitted when you acquire property. You can complete it online through the AADE portal, but you must first register your details if you haven’t already.

- Complete the E9 form: Provide accurate details about the property, such as its location, size, age, and floor level. This information determines your ENFIA tax calculation.

- Receive your tax assessment notification: Once the E9 form is submitted, the system calculates your tax. You’ll receive a notification via email or through the AADE portal, detailing both the main and supplementary taxes.

- Pay the ENFIA tax: As noted, you can pay the tax in full or in installments.

If you’re from abroad, you may already be familiar with property taxes similar to ENFIA. However, ENFIA is a sensitive topic for many Greeks, as it was introduced during the financial crisis. Some property owners have been forced to sell their homes due to an inability to pay the tax. While ENFIA may not seem substantial compared to a property’s value, it’s an expense all buyers should account for.

Binge-Worthy Greek Series & Movies On Netflix

Greek series and movies are making waves on Netflix, offering viewers captivating stories, stunning visuals, and a glimpse into Greek culture and history. Whether you're a fan of dark thrillers, emotional dramas, or historical epics, there’s something for everyone. Here are some binge-worthy Greek titles to dive into!

1. Σώσε Με (Save Me) – 2022 (Series, 8 Episodes)

For fans of dark, Harlan Coben-style thrillers, Save Me is an absolute must-watch. This intense series, set against the stunning backdrop of Komotini, is filled with twists and turns that will keep you on the edge of your seat. It dives deep into the struggles of minorities in Greece, shedding light on the hardships they face while delivering a gripping, fast-paced narrative. With beautiful cinematography and an atmospheric tone, this show is a standout.

Watch the trailer HERE!

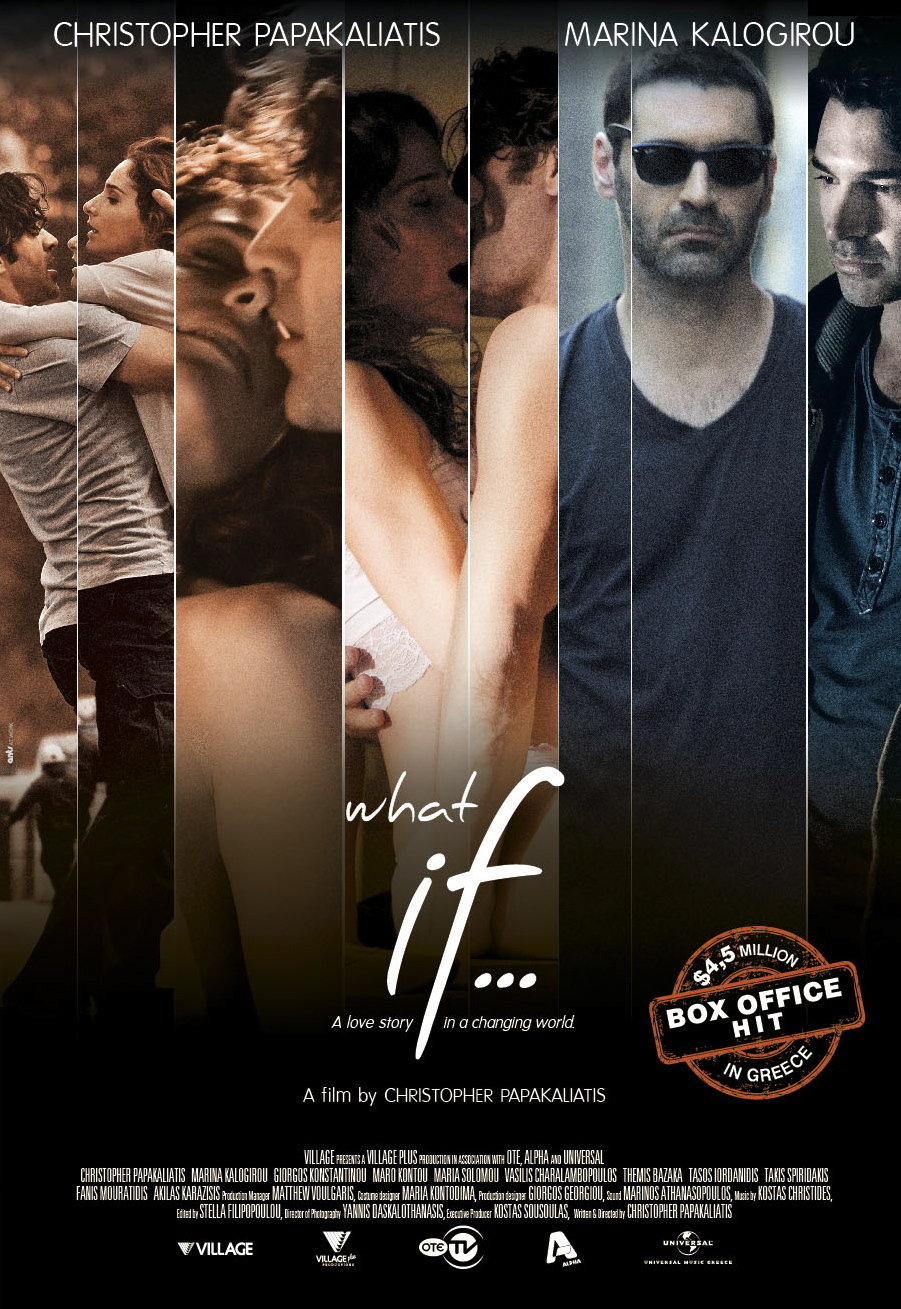

2. Αν... (What If) – 2012 (Movie)

What if every decision you made could change the course of your life? Similar to Sliding Doors with Gwyneth Paltrow, written and directed by Christoforos Papakaliatis, this film stars, among others, two legendary Greek actors, Giorgos Konstantinou and Maro Kontou, from the golden era of Greek cinema. It weaves a story of love, passion, and betrayal, exploring how the choices we make shape our destiny. Perfect for those who enjoy heartfelt dramas with a philosophical twist.

Watch the trailer HERE!

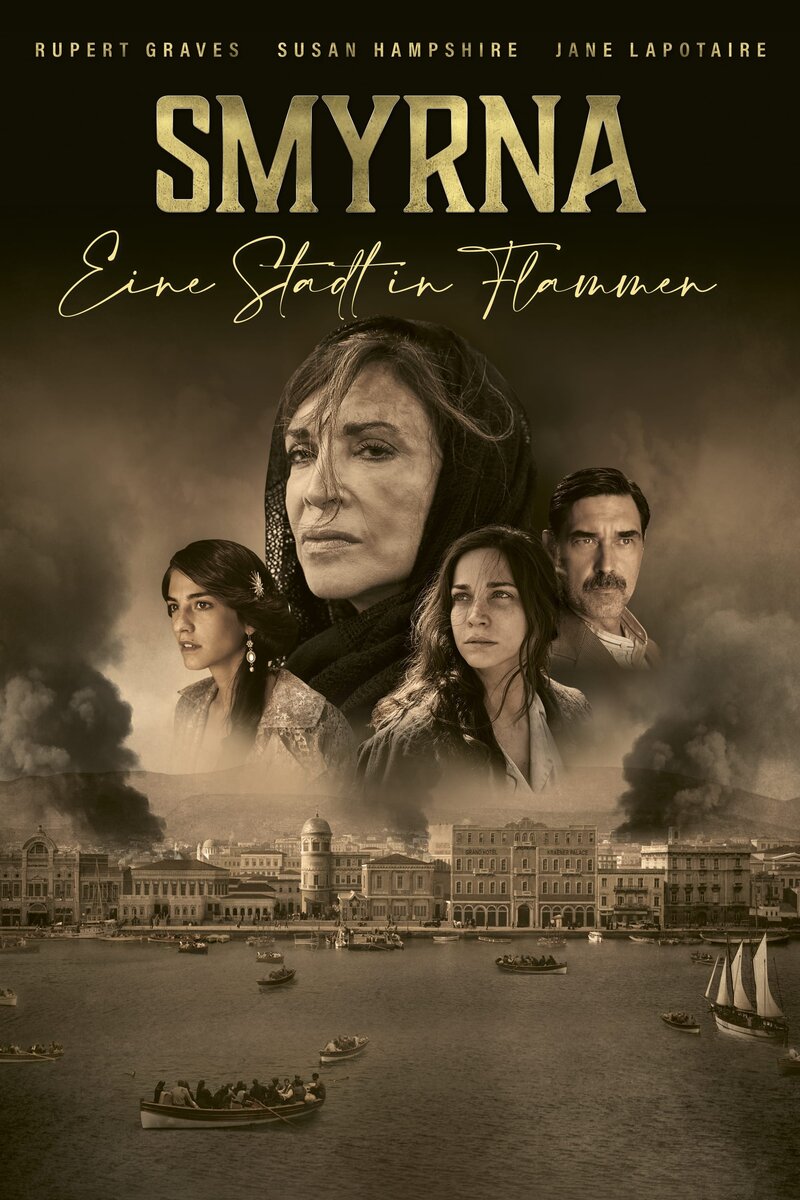

3. Σμύρνη Μου Αγαπημένη (Smyrna My Beloved) – 2021 (Movie)

Written by Mimi Denisi, Smyrna My Beloved is a cinematic masterpiece and a gut-wrenching portrayal of one of the darkest chapters in Greek history. The film takes viewers on an emotional rollercoaster, recounting the tragedy of Smyrna and the suffering endured by the Greek people. While it’s not for the faint-hearted, it’s a powerful and unforgettable experience that pays tribute to resilience and survival.

Watch the trailer HERE!

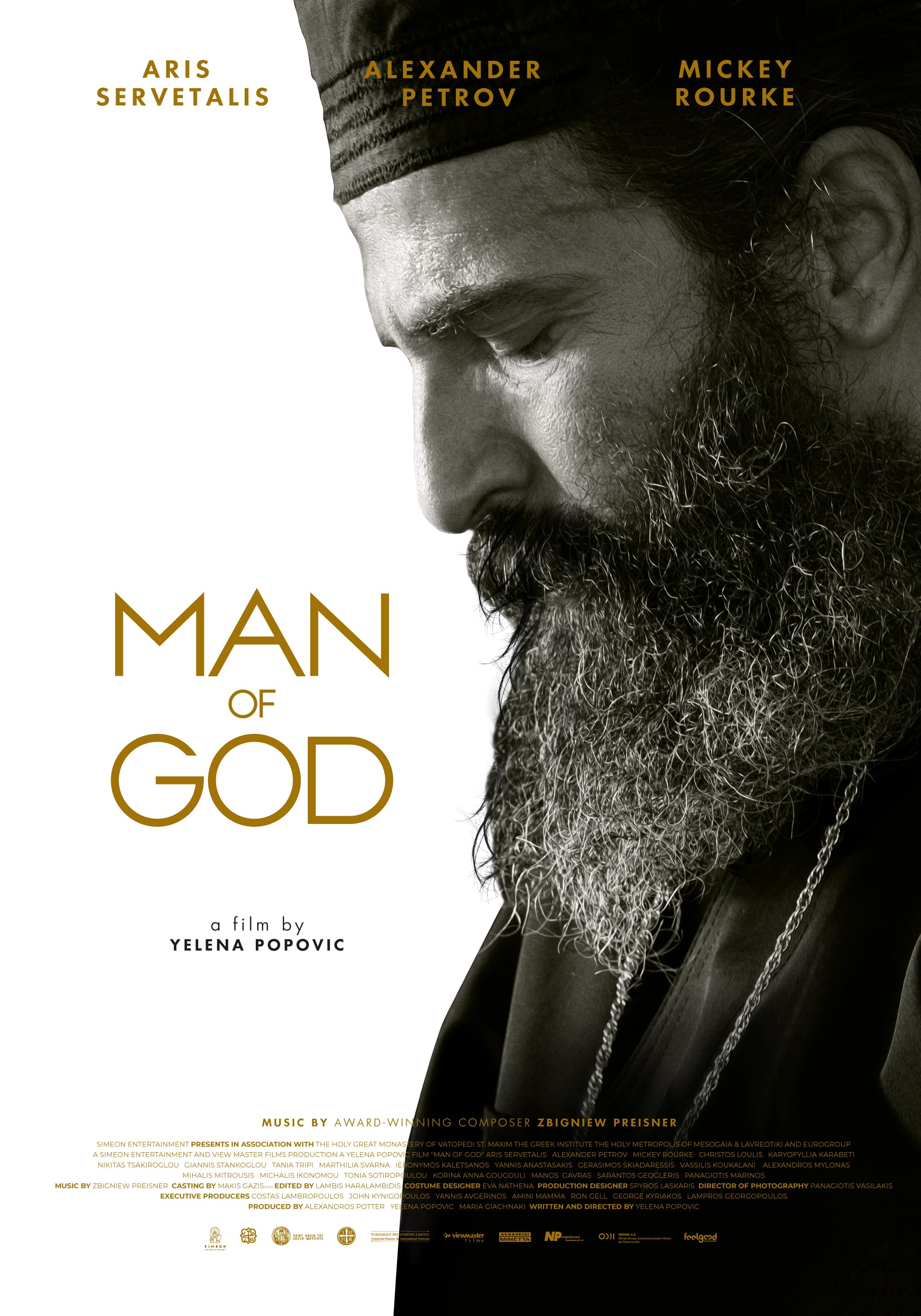

4. Man of God – 2021 (Movie)

This biographical drama chronicles the life of Saint Nektarios, a revered figure in Greek Orthodox Christianity. Man of God delves into themes of faith, persecution, and redemption, with an outstanding performance by Aris Servetalis. The film’s serene pacing and moving narrative make it an inspiring watch for those looking for spiritual depth.

Watch the trailer HERE!

5. Maestro in Blue – 2022 (Series)

Set on the breathtaking island of Paxoi, Maestro in Blue is more than a love story. With Haris Alexiou, one of the greatest Greek singers, in a pivotal role, the series explores human relationships, resilience, and the struggles of minorities. It celebrates strong women and the bonds that unite communities. Beautifully shot, the series captures the essence of Greek island life, blending it with complex characters and compelling storytelling.